I found another good candidate today for selling a put. I wrote one contract on CubeSmart (CUBE), a self-managed REIT focused primarily on the ownership, operation, management, acquisition, and

development of self-storage properties in the United States. They service about half the states in the country.

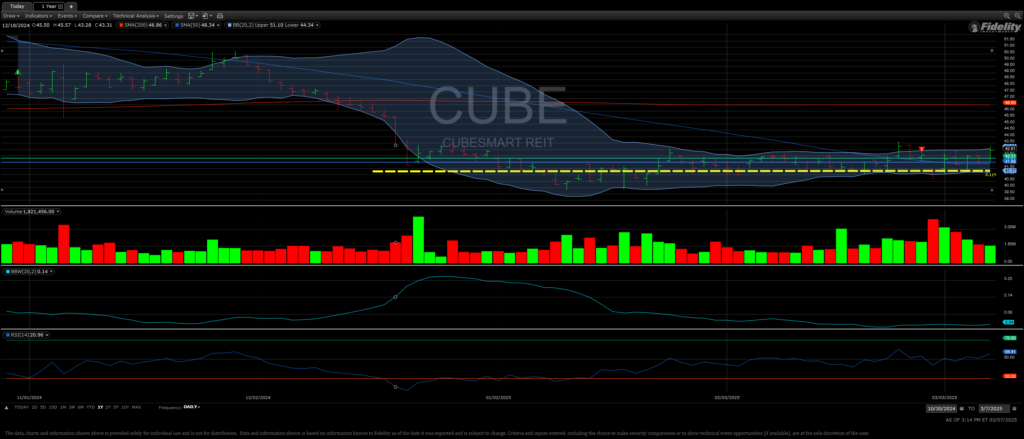

The chart below shows that, after taking a tumble in price following an earnings reprt, CUBE has been melting sideways around the horizontal dashed yellow line for several months. This level is also very near support. Initially oversold back in November/December, the RSI has been hovering mid-channel for several months. This seems an ideal set up to sell a put that we might anticipate could expire worthless.

If we do get assigned, we should pick these shares up at a good value. Sure Dividend has the “fair value” listed at $41/share in its February report. If assigned, we would pick up these shares for a cost basis of $39.01, nearly a 5% discount to fair value. Otherwise we will have collected the $99 premium and will move on.

The delta on this trade was about .29, indicating the market consensus that we could have a 29% chance of being assigned, or a 71% chance of just keeping the option contract premium.

| Option Type | Short Put (STO) |

| Date of Sale | 03/07/2025 |

| Option Sold | -CUBE250516P40 |

| Number Sold | 1 |

| Expiration Date | 05/16/2025 |

| Days to Expiration | 70 |

| Premium per Contract | $99.00 |

| Total Premium Received | $99.00 |

| Potential Liability/Cash Put Reserve | $4,000.00 |

| Company Ticker | CUBE |

| Stock Price at time of Put sale | $42.94 |

| Strike Price | $40.00 |

| Cost per Share if Assigned | $39.01 |

| Discount to Current Price If Assigned | 9.15% |

| Annual Dividend | $2.08 |

| Dividend Yield at Current Price | 4.84% |

| Dividend Yield on Cost if Assigned | 5.33% |

| Net ROI on Reserve If Not Assigned | 2.31% |

| Annualized ROI on Reserve If Not Assigned | 12.02% |